One America Whole Life insurance offers a unique blend of life insurance protection and cash value accumulation, presenting a compelling alternative to term life insurance for those seeking long-term financial security. This comprehensive guide delves into the intricacies of One America’s whole life policies, examining their features, costs, benefits, and suitability for various life stages.

We’ll explore the potential for cash value growth, the flexibility of policy loans, and the importance of understanding the company’s financial strength before making a decision.

From analyzing premium costs and comparing them to competitors to dissecting the nuances of riders and add-ons, we aim to provide a clear and concise understanding of One America Whole Life insurance. This analysis will empower potential policyholders to make informed decisions aligned with their individual financial goals and risk tolerance.

Policy Overview

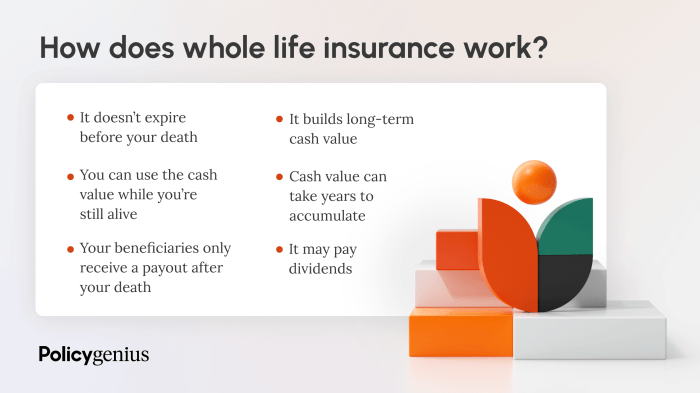

One America offers a range of whole life insurance policies designed to provide lifelong coverage and cash value accumulation. These policies differ from term life insurance, which provides coverage for a specified period, by offering permanent protection and a savings component that grows tax-deferred.

Understanding the nuances of these policies is crucial for making an informed financial decision.One America Whole Life insurance policies feature a fixed death benefit, meaning the payout to beneficiaries remains consistent throughout the policy’s duration. Premiums are typically level, remaining constant over the policyholder’s lifetime, providing predictable budgeting.

The policies also accumulate cash value, which grows tax-deferred and can be accessed through loans or withdrawals, though this impacts the death benefit. Policyholders can customize certain aspects, such as the death benefit amount and premium payment schedule, within available options.

The cash value component is influenced by the policy’s interest rate, which can fluctuate, albeit within specified parameters, and may not always match market performance.

Types of One America Whole Life Insurance

One America offers various whole life insurance products tailored to different needs and financial goals. Specific policy details and availability can vary based on state regulations and individual qualifications. While precise product names and features may change over time, One America generally provides options that cater to a spectrum of coverage amounts and premium payment structures.

This allows for flexibility in selecting a plan that aligns with an individual’s budget and long-term objectives. For example, some policies may focus on higher cash value growth, while others prioritize a larger death benefit. Consulting directly with One America or a qualified insurance agent is recommended to ascertain the most current offerings and their features.

Whole Life vs. Term Life Insurance

One America Whole Life insurance differs significantly from term life insurance. Whole life insurance provides lifelong coverage, while term life insurance offers coverage for a specific period, such as 10, 20, or 30 years. Whole life policies build cash value, whereas term life policies generally do not.

The premiums for whole life insurance are typically higher than for term life insurance, reflecting the permanent coverage and cash value component.The choice between whole life and term life insurance depends on individual circumstances and financial goals. Whole life insurance is suitable for those seeking lifelong coverage and a savings vehicle, while term life insurance is often more cost-effective for those needing coverage for a specific period, such as while raising a family or paying off a mortgage.

For example, a young family might opt for a term life policy to cover the mortgage, while someone nearing retirement might choose whole life for its lifelong protection and potential for tax-advantaged cash accumulation. A comprehensive financial plan should guide this crucial decision.

Cost Analysis

One America Whole Life insurance premiums, like those of any life insurance policy, are influenced by a complex interplay of factors. Understanding these factors is crucial for prospective buyers to make informed decisions and compare One America’s offerings with those of competitors.

This analysis will dissect the key components determining premium costs and provide comparative examples.

Factors Influencing One America Whole Life Insurance Premiums

Several key factors contribute to the overall cost of One America Whole Life insurance premiums. These factors are individually assessed and then combined to calculate the final premium. Age is a primary driver; younger individuals generally receive lower premiums due to their statistically longer life expectancy.

Health status plays a significant role, with applicants exhibiting pre-existing conditions or engaging in high-risk activities typically facing higher premiums to reflect the increased risk to the insurer. The desired death benefit amount directly impacts the premium; larger death benefits necessitate higher premiums.

Finally, the policy’s cash value accumulation feature, a core element of whole life insurance, influences the premium calculation. The higher the cash value growth, the higher the premium.

Premium Cost Comparison with Competitors

Direct premium comparisons between One America and competitors require specific policy details (age, health, coverage amount, etc.) for accurate assessment. However, general observations can be made. One America often competes in the space of other mutual life insurance companies, meaning their pricing structures may emphasize long-term value and stability over aggressive short-term cost competitiveness.

Independent financial advisors can provide personalized comparisons based on individual circumstances and financial goals, contrasting One America’s offerings with those of companies like Northwestern Mutual, MassMutual, or New York Life. These comparisons should focus on the overall cost of insurance over the policy’s lifetime, considering factors like cash value growth and potential dividends.

Example Premium Costs

The following table presents illustrative premium costs for One America Whole Life insurance. These are hypothetical examples and should not be considered guaranteed quotes. Actual premiums will vary based on the factors discussed previously. It’s crucial to obtain a personalized quote from One America or a qualified insurance agent for accurate pricing.

| Age | $250,000 Coverage | $500,000 Coverage | $1,000,000 Coverage |

|---|---|---|---|

| 35 | $XXX per month | $YYY per month | $ZZZ per month |

| 45 | $AAA per month | $BBB per month | $CCC per month |

| 55 | $DDD per month | $EEE per month | $FFF per month |

Cash Value Growth

One America Whole Life insurance policies accumulate cash value through a combination of premium payments and investment earnings. Unlike term life insurance, which provides coverage for a specified period, whole life insurance builds a cash value component that grows tax-deferred over the policy’s lifetime.

This growth is fueled by a portion of the premium payments allocated to the policy’s cash value account and the policy’s underlying investment performance. The insurer invests these funds, and the returns, less expenses, are credited to the policy’s cash value.The accumulation of cash value is a key feature of whole life insurance, offering policyholders a potential source of funds for future needs.

This growth is not guaranteed, as it depends on the performance of the underlying investments managed by the insurance company. However, policyholders can generally expect a relatively stable and predictable growth pattern, as the cash value is often credited with a minimum interest rate.

Cash Value Growth Illustration

Consider a 35-year-old individual purchasing a $500,000 One America Whole Life policy with an annual premium of $5,000. Assuming a conservative annual cash value growth rate of 4%, the cash value would accumulate over time as follows (this is a simplified example and does not include any potential charges or fees which could affect the actual cash value).

This illustration uses a hypothetical growth rate; actual returns will vary.

| Year | Beginning Cash Value | Annual Growth (4%) | Premium Payment | Ending Cash Value |

|---|---|---|---|---|

| 1 | $0 | $0 | $5,000 | $5,000 |

| 5 | $24,000 | $960 | $5,000 | $29,960 |

| 10 | $58,412 | $2,336 | $5,000 | $65,748 |

| 20 | $160,471 | $6,419 | $5,000 | $171,890 |

| 30 | $350,267 | $14,011 | $5,000 | $369,278 |

This example illustrates the potential for substantial cash value accumulation over a long period. Note that this is a simplified illustration and does not account for potential policy fees or changes in the credited interest rate. Actual results may vary.

Tax Implications of Accessing Cash Value

Accessing the cash value of a One America Whole Life policy typically involves loans or withdrawals. Loans against the cash value are generally tax-free, but interest accrues and must be paid. Failure to repay the loan could result in the policy lapsing.

Withdrawals, on the other hand, are subject to tax implications. The portion of the withdrawal that represents the accumulated earnings (above the cost basis) is taxed as ordinary income. The cost basis is the amount of premiums paid into the policy.

Careful financial planning is crucial to understand the tax implications of accessing the cash value to avoid unexpected tax liabilities.

Riders and Add-ons

One America offers a range of riders and add-ons designed to enhance the core benefits of its whole life insurance policies, allowing policyholders to customize their coverage to meet specific financial goals and needs. These supplemental benefits come at an additional cost, but can significantly increase the policy’s overall value and flexibility.

Careful consideration of individual circumstances is crucial when selecting riders, as their value proposition varies depending on the policyholder’s risk tolerance and financial objectives.

Available Riders and Add-ons

One America’s available riders typically include, but are not limited to, options for accelerated death benefits, long-term care coverage, and waiver of premium. The specific riders offered may vary depending on the policy type and the state of issue.

Each rider has its own associated cost, which is added to the base premium of the whole life policy.

Accelerated Death Benefit Rider

This rider allows policyholders to access a portion of their death benefit while they are still alive, typically in cases of terminal illness or critical illness. The amount accessible depends on the policy’s terms and the severity of the illness.

The cost of this rider is reflected in a higher premium, but it provides peace of mind and financial security during times of significant medical need. For example, a policyholder diagnosed with a terminal illness might access funds to cover medical expenses or alleviate financial burdens on their family.

Long-Term Care Rider

This rider provides coverage for long-term care expenses, such as nursing home care or in-home assistance. The benefit typically pays a daily or monthly amount to help cover these costs, which can be substantial. The premium for this rider will be higher than a policy without it, but it can offer significant protection against the financial burden of long-term care.

Consider a scenario where an individual requires extensive nursing home care for several years; the long-term care rider could substantially reduce the financial strain on their family.

Waiver of Premium Rider

This rider waives future premiums if the policyholder becomes totally and permanently disabled. This is particularly valuable as it ensures the policy remains in force even if the policyholder is unable to work and pay premiums. While adding a waiver of premium rider increases the initial premium cost, it offers crucial protection against the loss of coverage due to unforeseen circumstances.

Imagine a scenario where a policyholder experiences a disabling accident; the waiver of premium rider ensures continued coverage without the added financial pressure of premium payments.

Rider Combination Value Proposition

The optimal combination of riders depends heavily on individual needs and risk profiles. For example, a policyholder with a family history of serious illness might find the combination of accelerated death benefit and long-term care riders particularly valuable, providing both short-term and long-term financial protection.

Conversely, a younger, healthy individual might prioritize the waiver of premium rider to ensure continued coverage throughout their working years. Careful analysis of individual circumstances and financial planning are essential for determining the most appropriate rider selection.

Death Benefit

One America Whole Life insurance policies offer a guaranteed death benefit, a crucial component for financial security and estate planning. This benefit is paid to the designated beneficiary upon the death of the policyholder, providing a lump-sum payment to help cover final expenses and provide financial support for surviving family members.

The structure and calculation of this benefit are straightforward, though certain policy features can influence the final amount received.The death benefit in a One America Whole Life policy is typically the face amount of the policy, which is the amount selected by the policyholder at the time of purchase.

This amount remains constant throughout the policy’s life, regardless of market fluctuations or the policy’s cash value growth. The payment process is generally initiated upon receipt of a valid death claim, supported by the necessary documentation such as a death certificate and the policy documents.

The beneficiary will then receive the death benefit according to the payment instructions Artikeld in the policy.

Death Benefit Calculation

The death benefit calculation is primarily determined by the face value of the policy. For example, if a policyholder purchased a $100,000 One America Whole Life policy, the death benefit payable to the beneficiary would be $100,000, assuming no outstanding policy loans.

The calculation remains consistent unless specific riders or options are added to the policy that modify the death benefit, such as an accidental death benefit rider which might double or triple the death benefit under certain circumstances. Such riders would be clearly Artikeld in the policy documentation and their impact on the death benefit would be specified.

Impact of Policy Loans on the Death Benefit

Policy loans taken against the cash value of a One America Whole Life policy can impact the death benefit received. These loans are typically interest-bearing, and the outstanding loan balance, along with any accrued interest, will be deducted from the death benefit upon the policyholder’s death.

For instance, if a policyholder had a $100,000 policy with a $20,000 outstanding loan balance and $1,000 in accrued interest at the time of death, the beneficiary would receive $79,000 ($100,000

- $20,000

- $1,000). It’s crucial for policyholders to understand the potential impact of policy loans on the final death benefit payable to their beneficiaries. Careful planning and consideration of the loan’s implications are necessary to ensure the intended death benefit remains available for the beneficiaries.

Policy Loans and Withdrawals

One America Whole Life insurance policies offer policyholders the flexibility to access their accumulated cash value through loans and withdrawals. Understanding the terms and conditions associated with these options is crucial for maximizing the policy’s benefits and minimizing potential negative impacts on long-term growth.

This section details the process, associated costs, and the effects on both cash value and the death benefit.Policy loans and withdrawals provide access to the cash value built up within the policy. This can be a valuable tool for addressing unforeseen expenses or achieving specific financial goals.

However, it’s important to be aware that accessing these funds can affect the policy’s performance and future growth.

Policy Loan Process

Obtaining a policy loan involves submitting a formal request to One America. This typically involves completing an application form and providing any necessary supporting documentation. The loan amount is generally limited to the available cash value within the policy, minus any outstanding loans or other charges.

Funds are usually disbursed directly to the policyholder via check or direct deposit. The loan agreement will Artikel the repayment terms, including the interest rate and repayment schedule.

Withdrawal Process

Withdrawing funds from a One America Whole Life policy typically involves a similar process to obtaining a policy loan, though the specific requirements may vary. The policyholder submits a withdrawal request, and the funds are disbursed according to the terms Artikeld in the policy contract.

Withdrawal limits may apply, depending on the policy’s terms and the amount of accumulated cash value.

Interest Rates and Fees

Interest rates on policy loans are typically fixed and are determined by One America based on prevailing market conditions. These rates are generally competitive with other borrowing options, but it’s crucial to review the current rate before proceeding. Fees associated with policy loans and withdrawals may include administrative fees or early withdrawal penalties, depending on the policy terms and the amount withdrawn.

These fees should be clearly Artikeld in the policy documents. It’s recommended to carefully review the policy contract for a complete understanding of all applicable charges.

Impact on Cash Value and Death Benefit

Policy loans are considered debt against the policy’s cash value. While the policyholder is not obligated to repay the loan during their lifetime, interest accrues and is added to the outstanding loan balance. This reduces the policy’s cash value over time.

If the policyholder dies with an outstanding loan, the death benefit will be reduced by the loan amount plus any accrued interest. Withdrawals directly reduce the policy’s cash value, impacting its growth potential. They also may have a direct impact on the death benefit, depending on the policy terms.

For example, a large withdrawal could trigger a reduction in the death benefit, or a penalty. The policy’s specific terms and conditions will Artikel these impacts. Consulting with a financial advisor can help in understanding the potential long-term effects of loans and withdrawals on the overall value of the policy.

Company Reputation and Financial Strength

OneAmerica’s reputation and financial strength are critical considerations for potential policyholders. Understanding its financial stability, history, and any relevant controversies provides a comprehensive view of the company’s reliability and long-term viability as an insurance provider. A thorough assessment of these factors allows for a more informed decision-making process.OneAmerica, a prominent player in the life insurance market, boasts a long history.

Its financial stability is regularly evaluated by independent rating agencies, providing insights into its capacity to meet its policy obligations. Analyzing these ratings alongside the company’s historical performance and any notable events helps gauge its overall trustworthiness and resilience.

Financial Ratings and Stability

OneAmerica’s financial strength is assessed by several rating agencies, including A.M. Best, Moody’s, and Standard & Poor’s. These agencies utilize a complex methodology that considers factors such as the company’s reserves, investment performance, and overall management practices. Their ratings provide a valuable benchmark for assessing the insurer’s ability to pay claims and maintain its solvency.

For example, a high rating from a reputable agency indicates a lower risk of default and a greater likelihood of the company fulfilling its long-term commitments to policyholders. It is crucial to consult the most up-to-date ratings from these agencies before making any financial decisions.

Historical Performance and Market Position

OneAmerica’s history and market position offer valuable context for understanding its current standing. Established in 1909 as Bankers Life, OneAmerica has grown to become a significant player in the life insurance industry. The company’s longevity reflects its ability to adapt to changing market conditions and maintain its financial solvency.

Its market position is further supported by the range of products and services it offers. Analyzing its market share, competitive strategies, and long-term growth trajectory provides additional insights into its overall stability and future prospects.

Significant Events and Controversies

A review of OneAmerica’s history reveals that like any large financial institution, it has faced challenges and controversies. It’s important to research any significant events, such as regulatory actions or lawsuits, to gain a complete understanding of the company’s track record.

While many large insurers have experienced periods of scrutiny, a thorough investigation into any past controversies will inform an assessment of the company’s response to such challenges and its commitment to transparency and ethical business practices. Transparency in addressing past issues contributes to building and maintaining public trust.

Comparison with Other Whole Life Products

One America’s Whole Life insurance policies compete in a crowded market. Understanding how its offerings stack up against similar products from major competitors requires a detailed examination of key features, costs, and benefits. This comparison focuses on several leading providers, highlighting areas where One America distinguishes itself and areas where other options might offer superior value depending on individual needs.

Key Differences in Whole Life Policies

A direct comparison requires considering specific policy types within each company’s portfolio, as features and pricing vary significantly. However, a general overview can be provided using illustrative examples. The following table compares One America’s Whole Life policy with similar offerings from Northwestern Mutual, MassMutual, and New York Life.

Note that these are simplified representations and specific policy details will vary based on individual circumstances and the specific policy chosen.

| Feature | One America | Northwestern Mutual | MassMutual | New York Life |

|---|---|---|---|---|

| Guaranteed Minimum Cash Value Growth | Moderate, varies by policy | Generally higher than average | Competitive with market averages | Strong, consistent growth |

| Initial Premium Costs | Moderate | Generally higher | Competitive | Slightly higher than One America |

| Death Benefit | Fixed, with potential for increases via riders | Fixed, with rider options for increases | Fixed, with rider options for increases | Fixed, with rider options for increases |

| Policy Loan Options | Available, with interest rates subject to change | Available, interest rates generally competitive | Available, interest rates competitive | Available, interest rates competitive |

| Rider Availability | Offers various riders, including long-term care | Extensive rider options | Comprehensive rider options | Wide range of riders |

| Company Financial Strength Ratings | Generally strong ratings from major agencies | Consistently high ratings | Consistently high ratings | Consistently high ratings |

Suitability for Different Life Stages

One America Whole Life insurance, with its potential for cash value growth and lifelong coverage, offers varying degrees of suitability depending on an individual’s life stage and financial goals. The policy’s flexibility allows it to adapt to changing needs, from establishing a foundation for the future to providing a secure retirement nest egg.

However, careful consideration of individual circumstances is crucial to determine optimal policy utilization at each stage of life.One America Whole Life insurance can be a valuable tool at various life stages, providing financial security and long-term planning opportunities. Its adaptability lies in its ability to serve multiple purposes, such as building wealth, securing a death benefit, and accessing funds via loans or withdrawals.

The policy’s structure allows for customized approaches based on individual needs and risk tolerance.

Young Adults

Young adults often prioritize debt reduction, saving for a down payment on a house, or building an emergency fund. A One America Whole Life policy can serve as a forced savings vehicle, building cash value over time while providing a substantial death benefit.

The relatively low premiums in the early years can be manageable even with limited income.Scenario: A 25-year-old recent college graduate secures a One America Whole Life policy with a modest premium, aiming to build long-term wealth while securing a future death benefit for their family.

They prioritize the policy’s cash value accumulation, viewing it as a long-term investment strategy supplementing their retirement savings.

Families

For families, One America Whole Life insurance offers a crucial safety net. The death benefit provides financial security for dependents in case of the untimely death of a parent or breadwinner. The policy’s cash value can also serve as a source of funds for education expenses or other significant family needs.Scenario: A 35-year-old parent with two young children purchases a One America Whole Life policy to guarantee a substantial death benefit, providing for their children’s education and future well-being in the event of their passing.

They also view the policy’s cash value as a potential source of funds for their children’s college education.

Retirees

In retirement, One America Whole Life insurance can provide a supplemental income stream through policy loans or withdrawals. The accumulated cash value can be accessed to supplement retirement income or cover unexpected expenses. The guaranteed death benefit also offers peace of mind, ensuring a legacy for heirs.Scenario: A 65-year-old retiree utilizes the accumulated cash value in their One America Whole Life policy to supplement their retirement income, making planned withdrawals to cover living expenses while maintaining a substantial death benefit for their beneficiaries.

They see the policy as a reliable and secure source of funds in their later years.

Application Process and Underwriting

Securing a One America Whole Life insurance policy involves a straightforward application process, followed by a thorough underwriting review to assess risk and determine premiums. The entire process is designed to be efficient and transparent, providing applicants with a clear understanding of each stage.The application process typically begins with an initial contact, either through a financial advisor or directly through One America’s website.

Applicants will complete an application form providing personal and health information. This information is crucial for the underwriters to accurately assess the risk associated with insuring the applicant.

Application Form Completion

Applicants are required to provide comprehensive personal details, including date of birth, address, occupation, and medical history. This detailed information is essential for the underwriting process and allows One America to accurately assess the risk involved. The application also requests information regarding any existing health conditions, family medical history, and lifestyle habits such as smoking or alcohol consumption.

Accuracy in this section is paramount as misrepresentation can affect the policy’s approval or premium rates. Specific questions will vary depending on the amount of coverage sought.

Underwriting Process and Factors Considered

Following application submission, One America initiates the underwriting process. This involves a thorough review of the provided information, supplemented by additional data collection as needed. Underwriters assess several key factors, including the applicant’s age, health history, family medical history, lifestyle choices, occupation, and the requested death benefit amount.

Applicants may be required to undergo a medical examination, which might include blood tests and other assessments to further clarify their health status. The goal is to determine the applicant’s life expectancy and overall risk profile, directly impacting premium calculations.

Required Documentation

Supporting documentation is often necessary to validate the information provided in the application. This may include medical records, doctor’s notes, or evidence of employment. The specific documentation required varies depending on individual circumstances and the complexity of the application.

For instance, applicants with pre-existing health conditions might be asked to provide more detailed medical history. One America will clearly communicate what documentation is needed throughout the process. Prompt submission of the requested documents helps expedite the underwriting review.

Potential Long-Term Financial Implications

One America Whole Life insurance offers a unique opportunity to build long-term wealth alongside a guaranteed death benefit. Unlike term life insurance, which provides coverage for a specific period, whole life policies accumulate cash value that grows tax-deferred over time.

This cash value can be accessed through loans or withdrawals, providing a flexible financial resource for various long-term goals. Understanding the potential financial implications is crucial for assessing the policy’s suitability for individual financial plans.The long-term financial benefits of a One America Whole Life policy stem primarily from the compounding growth of its cash value.

This cash value grows at a rate determined by the policy’s interest rate, which is typically a fixed rate or a rate tied to a specific index. Consistent contributions, even relatively small ones, can significantly enhance the policy’s overall value over decades.

This allows policyholders to potentially leverage their policy for various financial objectives, including retirement planning, education funding, or estate planning.

Cash Value Growth Projections

A hypothetical example illustrates the potential for long-term growth. Consider a 35-year-old individual purchasing a One America Whole Life policy with an annual premium of $5,000 and a guaranteed minimum interest rate of 3%. A simplified illustration, ignoring potential dividend additions and assuming consistent premium payments, shows a projected cash value of approximately $300,000 after 25 years and over $700,000 after 40 years.

This illustration is for illustrative purposes only and does not represent a guaranteed return. Actual cash value will depend on several factors including policy type, premium amounts, and the actual interest credited each year. A visual representation of this could be a line graph with years on the x-axis and cash value on the y-axis, showcasing an upward sloping curve that steepens over time, reflecting the power of compounding.

The graph would clearly show distinct points at 25 and 40 years, marking the approximate cash values of $300,000 and $700,000 respectively. The graph would also include a legend indicating the hypothetical interest rate and premium amount used in the calculation.

Utilizing Cash Value for Long-Term Goals

The accumulated cash value within a One America Whole Life policy can serve as a valuable resource for various long-term financial goals. For instance, policyholders might utilize policy loans or withdrawals to supplement retirement income, reducing reliance on other retirement savings.

Another example is using the cash value to fund a child’s college education, offering a financial safety net without incurring high-interest debt. Furthermore, the policy’s death benefit ensures a financial legacy for beneficiaries, providing for their future needs and financial security.

Access to these funds depends on the specific terms and conditions of the policy and any applicable fees or penalties. It’s crucial to carefully consider the tax implications associated with accessing cash value.

Long-Term Tax Advantages

The tax-deferred nature of the cash value growth represents a significant long-term advantage. While taxes are not avoided entirely, they are only paid upon accessing the cash value or upon the beneficiary receiving the death benefit, allowing for potential tax-efficient wealth accumulation.

This contrasts with taxable investment accounts where gains are typically taxed annually. This deferral of taxes can lead to significant long-term tax savings compared to alternative investment strategies. The specific tax implications will vary depending on individual circumstances and applicable tax laws.

Consulting with a tax advisor is recommended to fully understand the tax implications related to a One America Whole Life policy.

Conclusion

One America Whole Life insurance, with its blend of lifelong coverage and cash value accumulation, presents a powerful tool for long-term financial planning. While the initial premiums may be higher than term life insurance, the potential for cash value growth and the flexibility offered by policy loans can significantly benefit individuals across various life stages.

However, careful consideration of individual financial circumstances, long-term goals, and a thorough understanding of policy details are crucial before committing to this type of permanent coverage. Consulting with a financial advisor is recommended to determine if One America Whole Life insurance aligns with your specific needs.