Wisconsin residents seeking affordable health insurance options have a valuable resource at their disposal: the Health Insurance Marketplace. Established under the Affordable Care Act (ACA), the Marketplace offers a range of plans that cater to diverse needs and budgets, providing access to quality healthcare for individuals and families across the state.

This guide delves into the intricacies of Wisconsin’s Marketplace, offering comprehensive information on plan types, eligibility criteria, enrollment processes, and cost considerations. We’ll explore the various health insurance providers, coverage options, and the role of subsidies in making healthcare more accessible.

Understanding Marketplace Insurance in Wisconsin

Navigating the world of health insurance can be daunting, especially when trying to understand the intricacies of the Affordable Care Act (ACA) and its impact on Wisconsin’s healthcare landscape. This guide provides a comprehensive overview of Marketplace insurance in Wisconsin, explaining the various plan options available, the benefits they offer, and how the ACA has transformed healthcare access for residents.

Types of Marketplace Insurance Plans

Wisconsin residents have access to a range of Marketplace insurance plans, each offering different coverage levels and features. These plans are categorized into four metal tiers, reflecting the level of coverage provided:

- Bronze: These plans cover the lowest percentage of healthcare costs, with the individual paying a higher out-of-pocket share.

- Silver: Silver plans offer a balance between coverage and out-of-pocket expenses.

- Gold: Gold plans provide a higher level of coverage compared to Bronze and Silver, resulting in lower out-of-pocket costs.

- Platinum: These plans offer the highest level of coverage, with the lowest out-of-pocket expenses for individuals.

Beyond the metal tiers, Marketplace plans in Wisconsin are also classified as either HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization).

- HMOs typically have a lower monthly premium but require individuals to choose a primary care physician (PCP) and seek referrals for specialists.

- PPOs offer greater flexibility, allowing individuals to visit any provider within the network without requiring a referral. However, they usually have higher monthly premiums.

The Affordable Care Act (ACA) and Its Impact on Wisconsin

The ACA, also known as Obamacare, has significantly impacted healthcare access in Wisconsin. Key provisions of the ACA include:

- Expansion of Medicaid: The ACA expanded Medicaid eligibility in Wisconsin, providing coverage to low-income individuals and families. This expansion has significantly increased access to healthcare for previously uninsured residents.

- Creation of Health Insurance Marketplaces: The ACA established online marketplaces where individuals can compare and purchase health insurance plans. These marketplaces offer subsidies to help individuals afford coverage.

- Essential Health Benefits: The ACA mandates that all Marketplace plans must cover essential health benefits, including preventive care, prescription drugs, and mental health services. This ensures that individuals have access to comprehensive healthcare coverage.

Key Benefits and Features of Marketplace Insurance Plans

Marketplace insurance plans in Wisconsin offer a variety of benefits and features, including:

- Financial Assistance: Individuals may be eligible for premium tax credits and cost-sharing reductions to help reduce their out-of-pocket expenses.

- Preventive Care: Marketplace plans cover preventive services, such as screenings and vaccinations, without any out-of-pocket costs.

- Essential Health Benefits: As mandated by the ACA, all Marketplace plans cover essential health benefits, ensuring comprehensive coverage.

- Consumer Protections: The ACA provides consumer protections, such as prohibiting insurers from denying coverage based on pre-existing conditions.

Eligibility and Enrollment Process

Navigating the Health Insurance Marketplace in Wisconsin requires understanding eligibility criteria and the enrollment process. This section delves into the specifics of qualifying for Marketplace coverage and the steps involved in enrolling.

Eligibility Criteria

To be eligible for Marketplace insurance in Wisconsin, individuals must meet certain criteria related to residency, income, and citizenship status.

- Residency: You must reside in Wisconsin to be eligible for Marketplace insurance.

- Income: Your income must fall within specific limits determined by the federal government. These limits vary based on household size and are updated annually. For instance, in 2023, a single individual with an annual income of up to $51,520 qualifies for Marketplace coverage.

- Citizenship Status: You must be a U.S. citizen, national, or lawful permanent resident to qualify for Marketplace insurance.

Enrollment Process

The enrollment process for Marketplace insurance in Wisconsin is straightforward and can be completed online, by phone, or through an in-person assister.

- Accessing the Marketplace Website: The first step involves visiting the official Health Insurance Marketplace website, healthcare.gov. Here, you’ll find detailed information about Marketplace plans and eligibility criteria.

- Creating an Account: Once on the website, you’ll need to create an account by providing basic personal information, such as your name, address, and Social Security number.

- Providing Documentation: During the enrollment process, you’ll be asked to provide documentation to verify your income, residency, and citizenship status. This may include tax returns, pay stubs, or a valid driver’s license.

- Choosing a Plan: Based on your income and family size, you’ll be presented with a range of insurance plans that meet your eligibility requirements. You can compare plans based on factors such as monthly premiums, deductibles, and coverage.

- Enrolling in Coverage: Once you’ve chosen a plan, you can enroll in coverage by completing the online application process. Your enrollment will be confirmed, and you’ll receive your insurance card within a few weeks.

Navigators and Assisters

Navigators and assisters are trained professionals who provide guidance and support to individuals navigating the Marketplace enrollment process. They can help you understand your eligibility, compare plans, and complete the enrollment application.

- Navigators: Navigators are community-based organizations that offer free, unbiased assistance with Marketplace enrollment. They can help you understand your options, compare plans, and complete the enrollment process.

- Assisters: Assisters are trained professionals who work at various locations, such as libraries, community centers, and insurance agencies. They can provide personalized assistance with Marketplace enrollment, including helping you understand your eligibility, comparing plans, and completing the enrollment application.

Premiums and Cost-Sharing

Understanding the costs associated with Marketplace plans in Wisconsin is crucial for making informed decisions about health insurance. Premiums, the monthly payments you make for your insurance, are calculated based on several factors. Additionally, cost-sharing mechanisms, such as deductibles, copayments, and coinsurance, play a role in determining your out-of-pocket expenses for healthcare services.

Premium Calculation

Premiums for Marketplace plans in Wisconsin are determined by a combination of factors, including:

- Age: Older individuals generally pay higher premiums than younger individuals, reflecting the higher likelihood of needing healthcare services as they age.

- Location: Premiums can vary depending on the geographic area, reflecting differences in the cost of providing healthcare services in different parts of the state.

- Tobacco Use: Individuals who use tobacco products typically pay higher premiums due to the increased risk of health problems associated with smoking.

- Income: While premiums are not directly tied to income, income plays a significant role in determining eligibility for premium tax credits, which can significantly reduce the cost of coverage.

- Plan Category: The type of plan you choose (e.g., Bronze, Silver, Gold, Platinum) will also affect your premium. Plans with higher benefits and lower cost-sharing typically have higher premiums.

Cost-Sharing Mechanisms

In addition to premiums, Marketplace plans also have cost-sharing mechanisms that determine how much you pay for healthcare services out-of-pocket. These mechanisms include:

- Deductible: This is the amount you must pay out-of-pocket before your insurance begins to cover healthcare costs. For example, if your deductible is $1,000, you will need to pay the first $1,000 of your healthcare expenses yourself before your insurance kicks in.

- Copayments: These are fixed amounts you pay for specific healthcare services, such as doctor visits or prescription drugs. For instance, you might have a copayment of $20 for a primary care doctor visit or $10 for a generic prescription drug.

- Coinsurance: This is a percentage of the cost of healthcare services that you pay after your deductible has been met. For example, a coinsurance rate of 20% means you pay 20% of the cost of healthcare services after your deductible is satisfied, while your insurance covers the remaining 80%.

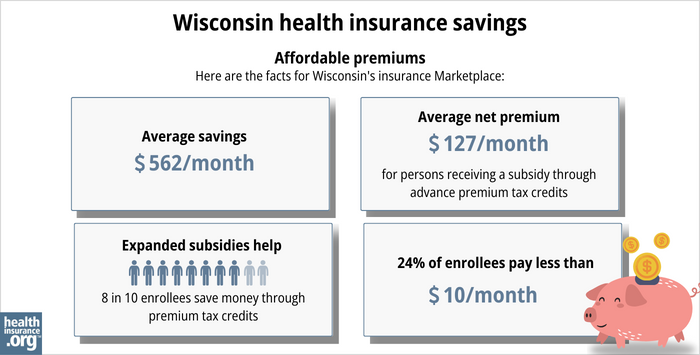

Premium Tax Credits and Subsidies

To make health insurance more affordable, the Affordable Care Act (ACA) provides premium tax credits and subsidies to eligible individuals and families. These financial assistance programs help reduce the cost of monthly premiums and make coverage more accessible.

- Premium Tax Credits: These tax credits are available to individuals and families with incomes below certain thresholds. The amount of the tax credit depends on your income, family size, and the cost of insurance in your area. The tax credit is applied directly to your monthly premium, reducing the amount you pay each month.

- Cost-Sharing Reductions: These subsidies help lower your out-of-pocket costs for healthcare services, such as deductibles, copayments, and coinsurance. The amount of the cost-sharing reduction depends on your income and the type of plan you choose. These reductions are applied directly to your healthcare bills, reducing the amount you pay at the time of service.

Available Health Plans and Providers

Wisconsin’s Health Insurance Marketplace offers a variety of health insurance plans from different insurance companies, allowing individuals and families to choose the best option for their needs and budget. The Marketplace helps connect consumers with health insurance plans that meet their specific requirements, such as coverage for pre-existing conditions or preferred healthcare providers.

Major Health Insurance Companies in Wisconsin

The Health Insurance Marketplace in Wisconsin features plans from several reputable insurance companies, including:

- Anthem Blue Cross and Blue Shield: A leading health insurance provider with a wide network of doctors and hospitals throughout Wisconsin.

- UnitedHealthcare: A national health insurance company offering a range of plans, including HMOs, PPOs, and EPOs, in the Wisconsin Marketplace.

- Medica: A health insurance company with a strong presence in Wisconsin, offering affordable plans to individuals and families.

- Humana: A national health insurance provider offering a range of plans, including Medicare Advantage plans, in the Wisconsin Marketplace.

- Molina Healthcare: A health insurance company that focuses on serving low-income and underserved populations in Wisconsin.

Plan Options and Coverage

The Health Insurance Marketplace offers a variety of health plan options, each with different coverage levels and costs. Understanding the differences between these plans is crucial for making informed decisions about your health insurance.

- HMO (Health Maintenance Organization): HMO plans typically have lower monthly premiums but require you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility than HMOs, allowing you to see specialists without a referral. However, they often have higher monthly premiums and higher out-of-pocket costs for care outside the network.

- EPO (Exclusive Provider Organization): EPO plans are similar to HMOs, but they offer a wider network of providers. You’ll still need to choose a PCP within the network, and you’ll have limited coverage for care outside the network.

Healthcare Provider Availability

The availability of specific healthcare providers and specialists within Marketplace networks can vary depending on the plan you choose and your location in Wisconsin. It’s essential to research the provider networks of different plans before making a decision.

- Provider Directories: Most health insurance companies offer online provider directories that allow you to search for doctors and hospitals within their networks. You can use these directories to find providers who specialize in your specific needs, such as pediatrics, cardiology, or oncology.

- Network Size: Some plans have larger networks than others, meaning they have more providers available to you. Larger networks can offer greater flexibility and convenience, but they may also come with higher monthly premiums.

Open Enrollment and Special Enrollment Periods

Understanding the open enrollment period and special enrollment periods is crucial for accessing health insurance through the Marketplace in Wisconsin. These periods determine when you can enroll in or change your health insurance plan.

Annual Open Enrollment Period

The annual open enrollment period for Marketplace insurance in Wisconsin typically runs from November 1st to January 15th. During this time, you can:

- Enroll in a Marketplace plan for the first time.

- Switch to a different Marketplace plan.

- Renew your existing Marketplace plan.

It’s important to note that if you don’t enroll during the open enrollment period, you’ll need to wait for a special enrollment period or face a penalty for not having health insurance.

Special Enrollment Periods

Special enrollment periods allow individuals to enroll in or change their Marketplace health insurance outside of the open enrollment period. These periods are triggered by specific life events, such as:

- Loss of health coverage: If you lose your job or your employer-sponsored health insurance, you may qualify for a special enrollment period.

- Changes in household size: If you get married, have a baby, or adopt a child, you can enroll in a Marketplace plan.

- Changes in income: If your income changes significantly, you may be eligible for a different plan or subsidy.

- Moving to a new state: If you move to Wisconsin from another state, you may be eligible for a special enrollment period.

- Changes in household circumstances: If you experience a divorce or legal separation, you may be eligible for a special enrollment period.

It’s crucial to meet deadlines and complete the enrollment process within the designated timeframes. If you miss the deadline, you may not be able to enroll in a Marketplace plan until the next open enrollment period.

Resources and Support

Navigating the complexities of the Marketplace can be challenging, but numerous resources are available to assist Wisconsin residents. These resources offer guidance, support, and assistance throughout the enrollment process and beyond.

Wisconsin Department of Health Services

The Wisconsin Department of Health Services (DHS) serves as the primary source of information and assistance for Marketplace insurance in Wisconsin. DHS provides a dedicated website and call center to answer questions, offer enrollment support, and provide resources for understanding the program.

- Website: [Insert Website URL Here]

- Phone Number: [Insert Phone Number Here]

Other Relevant Agencies

In addition to DHS, several other agencies and organizations can offer assistance with Marketplace insurance. These organizations specialize in providing guidance and support to specific populations or with specific aspects of the program.

- Wisconsin Health Insurance Marketplace: The Marketplace website offers a comprehensive online platform for browsing plans, comparing costs, and enrolling in coverage. It also provides access to helpful resources, including FAQs, guides, and videos.

- Healthcare.gov: The federal Marketplace website provides additional resources and information for individuals seeking coverage nationwide.

- Local Community Health Centers: Community health centers often provide enrollment assistance and support to individuals in their communities. They may also offer discounted or sliding-scale fees for healthcare services.

- Consumer Assistance Organizations: Consumer assistance organizations advocate for consumers’ rights and provide guidance on navigating complex healthcare systems. They can offer support with understanding insurance policies, resolving disputes with insurance companies, and accessing essential healthcare services.

Consumer Protection Resources

Wisconsin residents have access to various consumer protection resources to address concerns or disputes related to Marketplace insurance. These resources ensure fair treatment and protect consumers’ rights within the healthcare system.

- Wisconsin Office of the Commissioner of Insurance: The Office of the Commissioner of Insurance investigates complaints and enforces insurance laws in Wisconsin. It offers a dedicated website and hotline for reporting issues or seeking assistance.

- Healthcare.gov: The federal Marketplace website provides information on consumer protection rights and resources, including details on filing complaints and appealing decisions.

- National Association of Insurance Commissioners (NAIC): The NAIC offers a consumer information website with resources on insurance issues and how to file complaints. It also provides a directory of state insurance departments, including the Wisconsin Office of the Commissioner of Insurance.

Comparing Marketplace Insurance to Other Options

Choosing the right health insurance plan can be a complex decision, especially with the many options available in Wisconsin. Understanding the pros and cons of different insurance options can help you make the best choice for your individual needs and circumstances.

Comparing Marketplace Insurance to Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a common option for many Wisconsin residents. However, Marketplace insurance offers several advantages that may make it a better choice for some individuals.

- Flexibility: The Marketplace allows you to choose from a wider variety of plans and providers than many employer-sponsored plans offer, giving you more control over your healthcare options.

- Subsidies: Depending on your income, you may be eligible for financial assistance through the Marketplace, which can significantly reduce your monthly premiums and out-of-pocket costs.

- Open Enrollment: The Marketplace offers open enrollment periods throughout the year, allowing you to change plans or enroll in coverage even if you don’t have a qualifying event.

- Access to Coverage: The Marketplace ensures access to affordable health insurance, regardless of your health status or pre-existing conditions.

However, employer-sponsored health insurance also has its advantages.

- Lower Premiums: Employer-sponsored plans often offer lower premiums than Marketplace plans, especially for individuals who receive employer contributions.

- Convenience: Enrollment and administration are typically handled through your employer, simplifying the process.

- Tax Advantages: Employer contributions to health insurance premiums are often tax-deductible for both the employer and employee.

Comparing Marketplace Plans to Other Individual Health Insurance Options

Marketplace plans are not the only individual health insurance option available in Wisconsin. Other options include individual plans purchased directly from insurance companies and plans offered through private exchanges.

- Directly Purchased Plans: These plans offer flexibility in choosing coverage but may be more expensive than Marketplace plans, especially for individuals who don’t qualify for subsidies.

- Private Exchanges: These platforms offer a range of individual plans from multiple insurance companies, but may not provide subsidies or other financial assistance.

Choosing the Best Insurance Option

The best insurance option for you depends on your individual needs and circumstances.

- Income: If you have a low to moderate income, Marketplace plans may be the most affordable option, especially with subsidies.

- Health Needs: If you have specific health needs or require specialized care, you may want to compare plans from different providers to find the best coverage for your needs.

- Budget: Consider your overall budget and out-of-pocket expenses when choosing a plan.

- Lifestyle: If you frequently travel or have a flexible work schedule, you may prefer a plan with more coverage options.

Ultimately, it’s essential to research and compare different insurance options before making a decision. Consult with a health insurance broker or advisor to get personalized guidance based on your individual circumstances.

Case Studies and Examples

Understanding how Marketplace insurance works in real-life scenarios can provide valuable insights into its benefits and potential challenges. Here, we delve into case studies illustrating various situations and their corresponding experiences with Marketplace insurance in Wisconsin.

Real-Life Examples of Marketplace Insurance in Wisconsin

The following table showcases diverse individuals and their experiences with Marketplace insurance in Wisconsin, highlighting the impact of subsidies, plan choices, and individual circumstances.

| Individual | Situation | Marketplace Experience |

|---|---|---|

| Sarah, a single mother of two | Sarah is a single mother of two young children who works part-time as a barista. She earns a modest income and struggles to afford health insurance. | Sarah was able to enroll in a Silver plan through the Marketplace and received a substantial tax credit, reducing her monthly premium to an affordable amount. She now has access to quality health care for herself and her children. |

| John, a self-employed contractor | John is a self-employed contractor who has experienced fluctuations in his income. He previously struggled to find affordable health insurance due to his unpredictable earnings. | John was able to enroll in a Bronze plan through the Marketplace and receive a tax credit, making coverage more affordable. The plan provides essential coverage while aligning with his fluctuating income. |

| Maria, a retiree | Maria is a retiree on a fixed income who needs affordable health insurance. She previously had employer-sponsored coverage but now needs to find a plan that fits her budget. | Maria was able to enroll in a Catastrophic plan through the Marketplace, which offered limited coverage but significantly reduced her monthly premiums. This plan aligns with her limited healthcare needs as a retiree. |

Cost-Sharing Differences Between Marketplace Plans

Marketplace plans offer various levels of cost-sharing, impacting out-of-pocket expenses. The table below illustrates these differences, emphasizing the impact of subsidies and tax credits.

| Plan Type | Deductible | Co-pay (Doctor Visit) | Co-insurance | Premium (with Subsidies) |

|---|---|---|---|---|

| Bronze | $5,000 | $40 | 20% | $100 |

| Silver | $3,000 | $30 | 30% | $200 |

| Gold | $1,500 | $20 | 40% | $300 |

| Platinum | $1,000 | $10 | 50% | $400 |

Note: The above table represents hypothetical examples and actual costs may vary based on individual circumstances, location, and chosen plan.

Comparison of Marketplace Plans from Different Insurance Companies

The Marketplace offers plans from multiple insurance companies, each with unique coverage and costs. The following table compares plans from different insurance providers in Wisconsin, highlighting key differences.

| Insurance Company | Plan Type | Coverage Highlights | Monthly Premium (with Subsidies) |

|---|---|---|---|

| Company A | Silver | Includes comprehensive coverage, extensive provider network | $250 |

| Company B | Gold | Offers lower deductibles and co-pays, robust preventive care benefits | $320 |

| Company C | Bronze | Provides basic coverage at a lower cost, ideal for individuals with limited healthcare needs | $180 |

It’s crucial to compare plans from different insurance companies to find the best option based on individual needs and budget. The Marketplace website provides a comprehensive comparison tool to facilitate this process.

Future Trends and Developments

The Affordable Care Act (ACA) is a constantly evolving piece of legislation, and changes are likely to continue impacting the Wisconsin Marketplace. Furthermore, the healthcare landscape is undergoing significant transformations, which will affect how individuals access and pay for insurance. Understanding these trends is crucial for navigating the Marketplace effectively.

Potential Changes to the Affordable Care Act

The ACA has faced numerous legal challenges and political debates since its enactment. While the law remains in place, future changes are possible. Here are some potential scenarios and their potential impact on the Marketplace:

- Increased Subsidies: Some proposals aim to increase subsidies for Marketplace enrollees, making coverage more affordable for low- and middle-income individuals. This could lead to increased enrollment in the Marketplace and a broader reach of health insurance coverage.

- Changes to Eligibility Requirements: There could be adjustments to income thresholds or eligibility criteria for Marketplace subsidies. These changes could impact the number of individuals eligible for financial assistance and the overall participation in the Marketplace.

- Modifications to Essential Health Benefits: The ACA mandates that all Marketplace plans must cover a set of essential health benefits. Future changes could alter these requirements, potentially affecting the scope of coverage offered through the Marketplace.

Emerging Trends in Healthcare

The healthcare industry is undergoing rapid transformation, driven by factors such as technological advancements, changing consumer preferences, and the rise of value-based care. These trends have implications for individuals seeking insurance through the Marketplace:

- Telehealth Expansion: The adoption of telehealth has accelerated during the COVID-19 pandemic. Marketplace plans are increasingly incorporating telehealth services, offering greater access to healthcare remotely. This could lead to more convenient and affordable care options for individuals.

- Personalized Medicine: Advances in genomics and data analytics are enabling personalized medicine, tailoring treatment plans to individual needs. This trend could influence the design of Marketplace plans, offering coverage for personalized diagnostics and treatments.

- Focus on Prevention and Wellness: The healthcare industry is shifting towards preventative care and wellness programs. Marketplace plans may offer incentives for healthy behaviors, such as discounts for participating in wellness programs or preventive screenings.

Staying Informed About Updates

To stay informed about changes to the Marketplace, individuals can take the following steps:

- Visit the Healthcare.gov Website: The official website of the Marketplace provides up-to-date information on eligibility, enrollment, plan options, and any legislative changes.

- Contact the Wisconsin Department of Health Services: The state agency responsible for administering the Marketplace in Wisconsin offers resources and guidance on Marketplace enrollment and benefits.

- Subscribe to Email Updates: Both Healthcare.gov and the Wisconsin Department of Health Services provide email subscription options to receive notifications about changes to the Marketplace.

Wrap-Up

Understanding the Wisconsin Marketplace empowers individuals to make informed decisions about their health insurance, ensuring they choose a plan that aligns with their specific needs and financial capabilities. Whether you’re navigating the enrollment process for the first time or seeking to optimize your existing coverage, the resources and insights provided here serve as a valuable compass in your healthcare journey.