Navigating the world of small business insurance can feel like a maze, with a multitude of policies, factors, and costs to consider. But understanding the ins and outs of insurance is crucial for protecting your business from unforeseen risks and ensuring its long-term stability. This guide delves into the complexities of small business insurance, providing insights into key coverage types, cost-influencing factors, and strategies to optimize your insurance strategy.

From the fundamental types of insurance policies required for small businesses to the impact of industry, location, and business operations on premiums, we cover the essential aspects of this critical financial decision. We also explore cost-saving strategies, the role of insurance professionals, and the ever-evolving landscape of small business insurance.

Understanding Small Business Insurance

Navigating the world of small business insurance can feel overwhelming, but it’s crucial for safeguarding your business’s future. Understanding the different types of insurance policies available and their key coverage components is essential for making informed decisions.

Types of Small Business Insurance Policies

Small businesses need various insurance policies to protect against different risks. Here’s a breakdown of some common types:

- General Liability Insurance: This policy protects your business from claims arising from bodily injury or property damage caused by your business operations or your employees. It covers legal expenses, settlements, and judgments. For example, if a customer slips and falls in your store, general liability insurance would cover the resulting medical expenses and legal costs.

- Property Insurance: This policy covers damage or loss to your business property, including buildings, equipment, inventory, and furniture. It protects you against risks like fire, theft, vandalism, and natural disasters. Property insurance helps you recover from unexpected events and continue operating your business.

- Workers’ Compensation Insurance: This policy covers medical expenses, lost wages, and disability benefits for employees injured on the job. It’s mandatory in most states and protects your business from financial hardship if an employee is injured. This policy is crucial for attracting and retaining employees.

- Business Interruption Insurance: This policy provides financial protection when your business is forced to close due to a covered event, such as a fire or natural disaster. It covers lost income and ongoing expenses, allowing your business to recover and resume operations. It can be a lifeline for businesses that rely on consistent revenue streams.

- Commercial Auto Insurance: This policy covers vehicles used for business purposes, including cars, trucks, and vans. It provides liability coverage for accidents and damage to your vehicles. If your business uses vehicles for deliveries, sales, or transportation, this insurance is essential for protecting your assets and employees.

Significance of Insurance for Small Businesses

Insurance plays a vital role in protecting small businesses from financial ruin. It helps mitigate risks and provides a safety net in case of unexpected events.

“Insurance can help small businesses avoid financial disaster, allowing them to focus on their core operations and growth.”

- Risk Mitigation: Insurance transfers the financial burden of potential risks to the insurance company. This allows businesses to operate with peace of mind, knowing they have protection against unforeseen events.

- Financial Protection: Insurance provides financial compensation for losses incurred due to covered events. This helps businesses recover from setbacks and avoid crippling financial burdens.

- Business Continuity: Insurance policies, such as business interruption insurance, can help businesses stay afloat during disruptions, ensuring they can resume operations and avoid permanent closure.

- Legal Compliance: Some insurance policies, like workers’ compensation, are legally required in many jurisdictions. Failing to comply with these requirements can result in significant penalties and legal issues.

Factors Influencing Insurance Costs

Small business insurance premiums are influenced by a range of factors, with some being more significant than others. These factors can be broadly categorized into several key areas, each playing a critical role in determining the final cost of insurance.

Industry

The industry in which a business operates is a major determinant of insurance costs. Businesses in certain industries, such as construction or manufacturing, are inherently riskier than others, such as retail or services. These riskier industries often face higher premiums due to the increased likelihood of accidents, injuries, or property damage. For instance, a construction company would likely pay a higher premium for workers’ compensation insurance than a bookstore, due to the inherent risks associated with construction work.

Location

The location of a business can also influence insurance premiums. Businesses located in areas with higher crime rates, natural disaster risks, or traffic congestion may face higher premiums. For example, a restaurant located in a high-crime area may pay a higher premium for property insurance compared to a similar restaurant in a safer neighborhood. Similarly, businesses located in areas prone to hurricanes or earthquakes may pay higher premiums for natural disaster coverage.

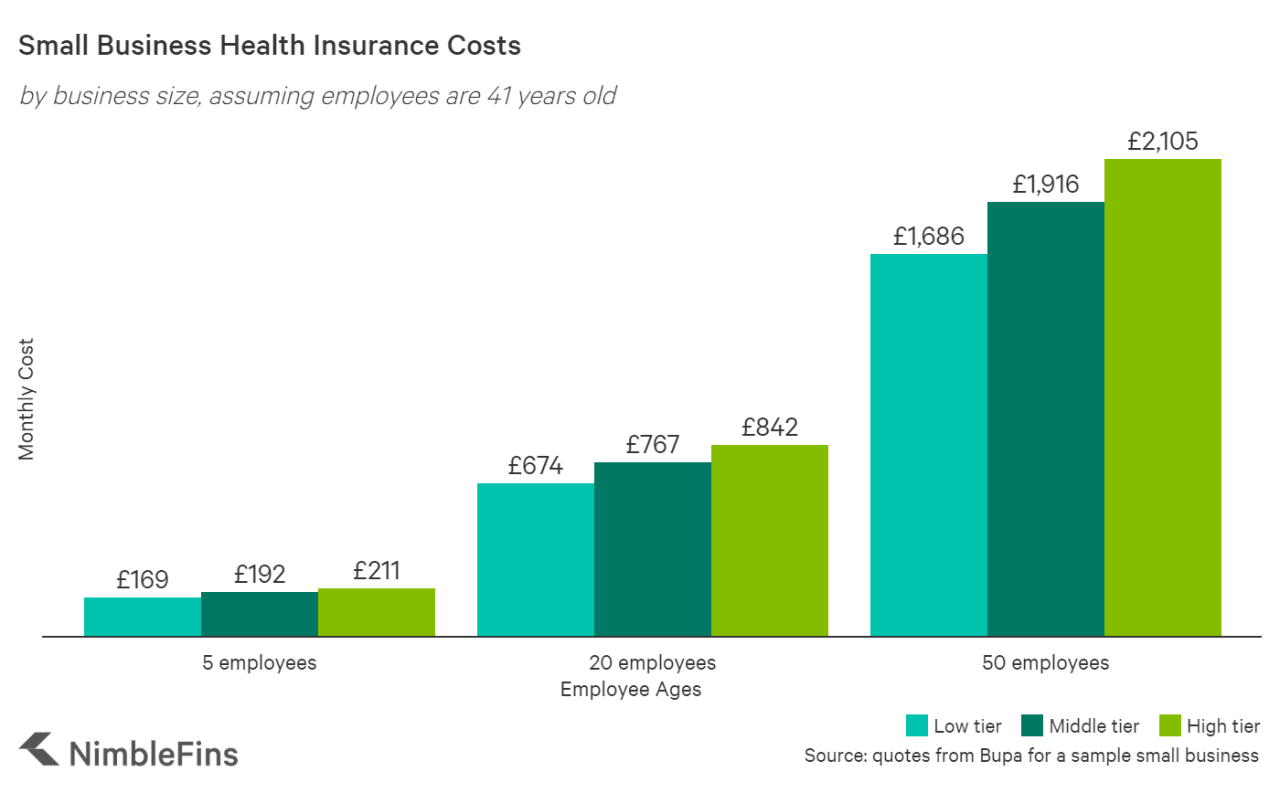

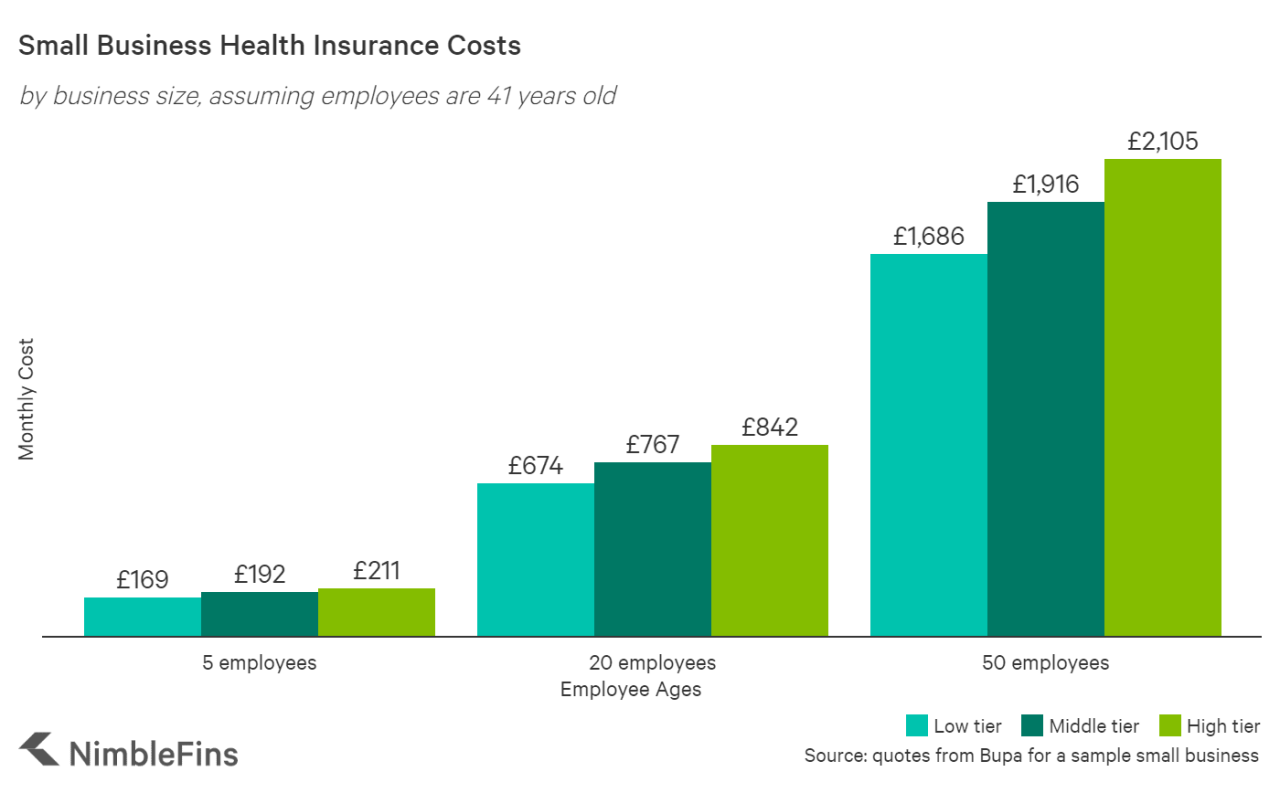

Business Size

The size of a business can also impact insurance costs. Larger businesses, with more employees and assets, typically face higher premiums than smaller businesses. This is because larger businesses have a greater potential for losses due to accidents, injuries, or property damage. For example, a large manufacturing plant would likely pay a higher premium for general liability insurance than a small bakery, due to the increased potential for liability claims in a larger operation.

Claims History

A business’s claims history plays a significant role in determining insurance premiums. Businesses with a history of frequent claims may face higher premiums, as insurers perceive them as higher risk. Conversely, businesses with a clean claims history may be eligible for discounts, as insurers view them as lower risk. For example, a business that has filed multiple workers’ compensation claims in the past may be charged a higher premium for future coverage, reflecting the insurer’s perception of increased risk.

Risk Assessment

Insurance companies conduct risk assessments to evaluate the potential for losses for each business. This assessment involves analyzing various factors, including the business’s operations, safety procedures, and financial stability. Based on the risk assessment, insurers determine the premium that reflects the perceived risk. Businesses that implement strong safety measures and have robust risk management practices may be eligible for lower premiums. For example, a business with a well-documented safety program and regular safety inspections may receive a lower premium for workers’ compensation insurance compared to a business with less robust safety protocols.

Common Insurance Types for Small Businesses

Navigating the world of small business insurance can be daunting, with numerous options available. Understanding the common types of insurance and their relevance to your specific business is crucial in ensuring adequate protection.

Common Insurance Types for Small Businesses

A comprehensive understanding of common insurance types is vital for every small business owner. The following table provides a succinct overview of essential insurance policies and their relevance to various businesses:

| Insurance Type | Coverage | Relevance to Small Businesses | Examples |

|—|—|—|—|

| General Liability Insurance | Protects against third-party claims for bodily injury, property damage, and personal injury, including slander and libel. | Essential for businesses that interact with the public, including retail stores, restaurants, and service providers. | A customer slips and falls in a retail store, a service provider accidentally damages a client’s property, or a business is sued for defamation. |

| Property Insurance | Covers physical damage to business property, including buildings, equipment, and inventory, caused by fire, theft, vandalism, or natural disasters. | Crucial for businesses that own or lease property, including retailers, manufacturers, and service providers. | A fire damages a restaurant’s kitchen, a thief steals inventory from a retail store, or a hurricane destroys a manufacturer’s warehouse. |

| Workers’ Compensation Insurance | Covers medical expenses, lost wages, and disability benefits for employees injured or become ill on the job. | Mandatory in most states for businesses with employees, including construction companies, healthcare providers, and retail stores. | An employee falls and breaks their leg while working at a construction site, a worker contracts a contagious disease while working at a healthcare facility, or an employee suffers a repetitive strain injury while working at a retail store. |

| Business Interruption Insurance | Provides financial protection to businesses experiencing a temporary shutdown due to a covered event, such as a fire or natural disaster. | Essential for businesses that rely on continuous operations, including restaurants, manufacturers, and service providers. | A fire forces a restaurant to close for repairs, a hurricane disrupts a manufacturer’s production, or a power outage shuts down a service provider’s operations. |

| Product Liability Insurance | Protects businesses from claims arising from defective products causing injury or damage to consumers. | Essential for businesses that manufacture, sell, or distribute products, including manufacturers, retailers, and distributors. | A customer is injured by a faulty product, a defective product causes property damage, or a consumer suffers illness due to a contaminated product. |

| Professional Liability Insurance (Errors and Omissions) | Protects professionals, such as lawyers, doctors, and accountants, against claims arising from negligent advice or services. | Crucial for businesses that provide professional services, including consulting firms, financial advisors, and insurance brokers. | A lawyer provides incorrect legal advice, a doctor makes a medical error, or an accountant provides inaccurate financial statements. |

| Cyber Liability Insurance | Protects businesses against financial losses and reputational damage caused by cyberattacks, including data breaches, ransomware attacks, and system failures. | Essential for businesses that store sensitive data, including financial institutions, healthcare providers, and technology companies. | A cyberattack compromises a company’s network, a ransomware attack encrypts critical data, or a data breach exposes customer information. |

| Commercial Auto Insurance | Covers vehicles used for business purposes, including trucks, vans, and company cars, against accidents, theft, and other risks. | Essential for businesses that use vehicles for delivery, transportation, or sales, including delivery companies, transportation services, and sales representatives. | A company truck is involved in an accident, a company car is stolen, or a delivery van is damaged in a storm. |

Examples of Specific Insurance Policies

The specific insurance policies purchased by businesses vary depending on the industry, size, and risk profile. Here are some examples of common policies purchased by businesses in different industries:

* Retail: General liability, property, workers’ compensation, product liability, business interruption

* Restaurants: General liability, property, workers’ compensation, liquor liability, business interruption

* Construction: General liability, property, workers’ compensation, builders risk, professional liability

* Healthcare: General liability, property, workers’ compensation, professional liability, cyber liability

* Technology: General liability, property, workers’ compensation, cyber liability, errors and omissions

Key Differences Between General Liability, Property, and Workers’ Compensation Insurance

Understanding the key differences between general liability, property, and workers’ compensation insurance is crucial for businesses to ensure adequate coverage.

| Insurance Type | Coverage | Key Differences |

|—|—|—|

| General Liability | Protects against third-party claims for bodily injury, property damage, and personal injury. | Covers injuries or damages caused to others by the business’s operations, products, or employees. |

| Property | Covers physical damage to business property, including buildings, equipment, and inventory. | Protects against losses due to fire, theft, vandalism, or natural disasters. |

| Workers’ Compensation | Covers medical expenses, lost wages, and disability benefits for employees injured or become ill on the job. | Provides financial protection for employees injured while performing their job duties. |

Cost-Saving Strategies for Small Business Insurance

Minimizing insurance premiums without compromising coverage is a crucial aspect of small business financial management. Several strategies can help reduce insurance costs while ensuring adequate protection.

Bundling Insurance Policies

Bundling multiple insurance policies with a single provider can often lead to significant cost savings. This strategy leverages the economies of scale that insurers enjoy when providing multiple policies to a single customer.

- By bundling policies such as property, liability, and workers’ compensation, businesses can often negotiate lower premiums compared to purchasing individual policies from different insurers.

- Bundling also simplifies policy management, reducing administrative overhead and potential for errors.

Implementing Risk Management Practices

Proactive risk management measures can significantly reduce the likelihood of claims and, consequently, lower insurance premiums.

- Investing in safety training for employees, implementing security measures, and maintaining proper records can demonstrate a commitment to safety and risk mitigation, making the business a less risky prospect for insurers.

- For example, a business that implements a comprehensive safety program with regular training sessions for employees, leading to a reduction in workplace accidents, can expect a lower workers’ compensation premium.

The Impact of Business Operations on Insurance Costs

The nature of your business operations significantly influences the cost of your insurance premiums. Insurance companies assess various aspects of your business, including employee size, work environment, and product liability, to determine your risk profile and set appropriate premiums. Understanding how these factors impact insurance costs can help you make informed decisions to manage your insurance expenses effectively.

Employee Size and Insurance Costs

The number of employees your business employs directly impacts the cost of workers’ compensation insurance. A larger workforce generally leads to higher premiums due to an increased risk of workplace accidents and injuries. Insurance companies often use a formula to calculate workers’ compensation premiums based on factors like payroll, industry classification, and accident history. For instance, a construction company with a large workforce and a high-risk work environment will typically pay higher premiums than a small office with fewer employees.

Work Environment and Insurance Costs

The nature of your work environment also influences your insurance premiums. Businesses with hazardous work environments, such as construction sites or factories, are considered higher risk and face higher insurance costs. Insurance companies carefully assess the potential for accidents and injuries based on the type of work, the use of machinery, and the presence of hazardous materials. For example, a manufacturing facility that uses heavy machinery and hazardous chemicals will likely have higher insurance premiums than a retail store with a less hazardous work environment.

Product Liability and Insurance Costs

If your business manufactures or sells products, you will need product liability insurance to protect you against claims arising from injuries or damages caused by your products. The cost of product liability insurance is influenced by factors such as the complexity of your products, the potential for harm, and your track record of product safety. Businesses that manufacture complex products with a higher risk of causing harm typically pay higher premiums. For instance, a pharmaceutical company that manufactures medications with potential side effects will likely face higher product liability insurance premiums than a bakery selling simple pastries.

Business Revenue and Insurance Costs

Generally, businesses with higher revenue tend to have higher insurance premiums. This is because insurance premiums are often calculated as a percentage of revenue, and businesses with higher revenue are considered to have a higher risk of loss. However, the relationship between revenue and insurance costs is not always linear. For instance, a small business with a specialized niche market may have lower insurance costs than a large company with a broader customer base, even if the small business has higher revenue.

Specific Business Practices and Insurance Costs

Several specific business practices can impact your insurance premiums. For example:

- Implementing safety programs: Businesses that have comprehensive safety programs and invest in safety training for their employees can often secure lower insurance premiums. This is because a strong safety culture reduces the risk of workplace accidents and injuries, leading to lower insurance claims.

- Maintaining a clean and organized work environment: A clean and organized work environment can reduce the risk of accidents and injuries, leading to lower insurance premiums. For instance, a manufacturing facility that maintains a clean and organized workspace with proper safety equipment can reduce the risk of slips, trips, and falls.

- Adopting sustainable practices: Businesses that adopt sustainable practices, such as reducing energy consumption and waste, can often receive discounts on insurance premiums. This is because insurance companies recognize that sustainable practices often lead to a safer and more efficient work environment.

The Importance of Adequate Coverage

For small businesses, having the right amount of insurance coverage is crucial. It provides a safety net against unexpected events that could threaten their financial stability and even their survival. Underestimating insurance needs can have serious consequences, leading to significant financial losses and legal complications.

The Consequences of Insufficient Insurance Coverage

Inadequate insurance coverage can expose small businesses to substantial financial and legal risks. Underinsurance occurs when the coverage limits are insufficient to cover the full cost of losses arising from an insured event. This can leave businesses facing substantial out-of-pocket expenses, potentially leading to bankruptcy or even closure.

Financial Implications of Underinsured Events

The financial implications of underinsurance can be severe, leaving businesses struggling to recover from unforeseen events.

- Out-of-Pocket Expenses: When insurance coverage is insufficient, businesses may have to cover the difference between the actual loss and the insurance payout out of their own pockets. This can lead to substantial financial strain, especially for small businesses with limited financial resources.

- Business Interruption: Underinsurance can also lead to business interruption, as businesses may be unable to fully recover from a covered event due to insufficient funds. This can result in lost revenue, decreased productivity, and even the need to lay off employees.

- Reduced Liquidity: Underinsurance can deplete a business’s cash reserves, making it difficult to meet its financial obligations, such as paying rent, salaries, and suppliers. This can lead to a cycle of debt and financial instability.

- Impact on Creditworthiness: The financial strain of underinsurance can negatively impact a business’s creditworthiness, making it harder to secure loans and financing in the future. This can hinder growth and expansion plans.

Legal Implications of Underinsured Events

Underinsurance can also have significant legal implications for small businesses, potentially leading to lawsuits and legal battles.

- Liability Claims: If a business is underinsured and is found liable for an accident or injury, it may be unable to fully cover the costs of settlements or judgments. This can result in significant financial losses and even bankruptcy.

- Contractual Obligations: Some contracts may require businesses to carry a certain level of insurance coverage. Failing to meet these requirements can lead to legal disputes and penalties.

- Regulatory Compliance: Certain industries or businesses may be subject to specific insurance requirements mandated by regulations. Non-compliance can result in fines and penalties.

Real-World Examples of Underinsurance

There are numerous real-world examples of small businesses that have suffered significant losses due to inadequate insurance coverage.

- Restaurant Fire: A restaurant owner with insufficient fire insurance coverage experienced a devastating fire that destroyed the kitchen and dining area. The insurance payout was not enough to cover the cost of repairs and lost business income, forcing the owner to close the restaurant permanently.

- Cyberattack: A small technology company was targeted by a cyberattack that compromised its data and systems. The company’s cyber liability insurance coverage was insufficient to cover the costs of data recovery, legal expenses, and lost business income. The company struggled to recover from the attack and eventually had to shut down.

- Natural Disaster: A small retail store located in a flood-prone area was damaged by a major flood. The business owner had underestimated the risk of flooding and had purchased insufficient flood insurance. The insurance payout was not enough to cover the cost of repairs and lost inventory, leaving the owner with significant financial losses.

The Role of Insurance Brokers and Agents

Navigating the complex world of small business insurance can be daunting, especially for entrepreneurs who are already juggling numerous responsibilities. Insurance brokers and agents play a crucial role in simplifying this process, offering expert guidance and tailored solutions to meet the unique needs of each business.

Services Offered by Insurance Brokers and Agents

Insurance brokers and agents provide a range of valuable services to small businesses, acting as intermediaries between businesses and insurance carriers. They possess extensive knowledge of the insurance market and can help businesses find the most suitable coverage at competitive prices.

- Needs Assessment and Policy Recommendation: Brokers and agents conduct a thorough assessment of a business’s operations, risks, and assets to identify specific insurance needs. They then recommend appropriate policies, ensuring adequate coverage for potential liabilities and losses.

- Policy Comparison and Negotiation: Brokers and agents leverage their relationships with multiple insurance carriers to compare policies and negotiate favorable terms, including premiums and coverage limits. This competitive analysis ensures businesses obtain the best value for their insurance investment.

- Claims Assistance: In the event of a claim, brokers and agents act as advocates for their clients, guiding them through the process and ensuring prompt and fair settlements. Their expertise in insurance regulations and procedures can streamline the claims process and maximize payouts.

- Policy Management and Renewal: Brokers and agents manage policy renewals, ensuring continuity of coverage and staying informed about any changes in insurance regulations or market conditions. They also provide ongoing support and advice to businesses throughout the policy lifecycle.

Benefits of Working with an Insurance Professional

Partnering with an insurance broker or agent offers numerous advantages for small businesses, including:

- Expertise and Knowledge: Insurance professionals possess in-depth knowledge of the insurance market, regulations, and industry best practices. They can provide valuable insights and guidance to ensure businesses have the right coverage for their specific needs.

- Time Savings: Navigating the insurance market and comparing policies can be time-consuming. Brokers and agents handle these tasks, allowing business owners to focus on their core operations.

- Cost Savings: Brokers and agents leverage their relationships with multiple carriers to negotiate competitive premiums and coverage terms. Their expertise can help businesses save money on their insurance costs.

- Peace of Mind: Knowing that a knowledgeable professional is managing their insurance needs provides businesses with peace of mind and confidence in their risk management strategies.

Selecting and Working with an Insurance Broker or Agent

Choosing the right insurance broker or agent is crucial for obtaining optimal coverage and maximizing value. Here are some key factors to consider when selecting an insurance professional:

- Experience and Expertise: Look for brokers or agents with proven experience in serving small businesses in your industry.

- Reputation and References: Check the broker or agent’s reputation by reading online reviews and requesting references from previous clients.

- Communication and Responsiveness: Ensure the broker or agent is communicative, responsive to your inquiries, and provides clear explanations of insurance policies and terms.

- Service Offerings: Consider the range of services offered by the broker or agent, including policy comparison, negotiation, claims assistance, and policy management.

Once you’ve selected an insurance broker or agent, establish clear communication channels and expectations. Regularly review your insurance needs with your broker or agent to ensure your coverage remains adequate and aligned with your evolving business operations.

Navigating Insurance Policies and Terms

Insurance policies are the cornerstone of your small business’s risk management strategy, but navigating their complexities can be daunting. Understanding the language and structure of these documents is crucial to ensuring you have the appropriate coverage and are not paying for unnecessary extras.

Glossary of Common Insurance Terms

A solid understanding of common insurance terms is essential for making informed decisions about your business’s insurance needs. Here is a glossary of key terms tailored for small businesses:

- Actual Cash Value (ACV): The depreciated value of an insured item at the time of loss. It is calculated by subtracting depreciation from the item’s replacement cost.

- Deductible: The amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

- Endorsement: A written amendment to an insurance policy that adds, modifies, or deletes coverage.

- Exclusion: A specific risk or situation that is not covered by your insurance policy.

- Insured: The person or entity covered by an insurance policy.

- Liability: Legal responsibility for damages or injuries caused to others.

- Premium: The amount you pay for your insurance policy.

- Replacement Cost: The cost to replace an insured item with a new, identical item.

- Rider: An addition to a policy that provides specific coverage for a particular risk.

Understanding Insurance Policy Sections

Insurance policies are structured to provide comprehensive coverage, with each section addressing a specific aspect of your business’s risk. Here’s a breakdown of essential policy sections and their significance:

| Section | Significance |

|---|---|

| Declarations Page | This page Artikels the basic information about your policy, including the insured, policy number, coverage periods, and premium amount. |

| Insuring Agreement | This section defines the risks covered by your policy and the insurer’s responsibilities in the event of a covered loss. |

| Exclusions and Conditions | This section lists the risks, situations, or events that are not covered by your policy. It also Artikels the conditions you must meet to receive coverage. |

| Definitions | This section provides definitions of key terms used throughout the policy. |

Reviewing and Understanding Insurance Policy Documents

Thoroughly reviewing your insurance policy is essential to ensure you have the coverage you need and understand the terms and conditions. Here’s a step-by-step guide:

- Read the entire policy carefully: Don’t just skim the document; take the time to read every section thoroughly.

- Focus on key sections: Pay particular attention to the Declarations Page, Insuring Agreement, Exclusions and Conditions, and Definitions sections.

- Highlight important terms: Use a highlighter or sticky notes to mark important terms and conditions that you need to understand.

- Ask questions: If you have any questions about the policy, don’t hesitate to contact your insurance agent or broker.

- Review the policy regularly: Make sure to review your policy annually or whenever your business undergoes significant changes.

The Future of Small Business Insurance

The small business insurance landscape is undergoing a significant transformation, driven by emerging trends and technological advancements. These changes are shaping how insurance is priced, delivered, and consumed, ultimately impacting the cost and accessibility of coverage for small business owners.

The Rise of Insurtech and Digital Platforms

The emergence of Insurtech companies, leveraging technology to disrupt traditional insurance models, is reshaping the industry. These companies are developing innovative platforms that streamline insurance processes, offer personalized pricing, and provide seamless customer experiences. For example, online platforms allow small business owners to obtain quotes, purchase policies, and manage claims entirely digitally, reducing administrative burdens and enhancing accessibility.

Data Analytics and Risk Assessment

Data analytics is revolutionizing how insurers assess risk and price policies. By leveraging vast datasets, insurers can gain deeper insights into small business operations, identify potential hazards, and tailor coverage accordingly. This data-driven approach enables more accurate risk assessments, potentially leading to more competitive pricing and customized insurance offerings.

Emerging Technologies and Coverage Models

Technological advancements are also driving innovation in insurance coverage models. For instance, the Internet of Things (IoT) is enabling insurers to monitor and manage risks in real-time, offering preventive measures and reducing claims. The use of drones for property inspections, artificial intelligence (AI) for fraud detection, and blockchain technology for secure data management are further transforming the insurance industry.

Personalized Pricing and Coverage

The future of small business insurance is likely to see a shift towards personalized pricing and coverage models. By leveraging data analytics, insurers can offer customized policies that cater to the specific needs and risks of individual businesses. This personalized approach can result in more affordable premiums for businesses with lower risk profiles, while also providing tailored coverage for businesses with unique needs.

The Role of Data and Risk Assessment in Shaping Future Offerings

Data analytics is playing a pivotal role in shaping future insurance offerings for small businesses. By analyzing vast amounts of data, insurers can identify emerging risks, predict potential claims, and develop customized coverage solutions. For example, data analysis can help insurers understand the impact of climate change on specific industries, allowing them to offer tailored policies that address these risks.

“Data analytics is transforming the way we assess risk and design insurance products. By leveraging data insights, we can provide more personalized and cost-effective coverage solutions for small businesses.” – CEO of a leading Insurtech company

The Future of Insurance Pricing

Insurance pricing models are also likely to evolve in the future. The use of dynamic pricing, based on real-time risk factors, can enable more accurate and responsive pricing. For example, insurers may adjust premiums based on factors such as weather conditions, traffic data, or even the performance of a business’s online reputation.

The Impact of Emerging Technologies on Insurance Costs

Emerging technologies are expected to have a significant impact on insurance costs for small businesses. The use of IoT devices can help businesses mitigate risks, reducing the likelihood of claims and potentially lowering premiums. For example, smart sensors can monitor temperature and humidity levels in warehouses, reducing the risk of fire or damage.

The Future of Small Business Insurance: A More Personalized and Data-Driven Approach

The future of small business insurance is likely to be characterized by a more personalized and data-driven approach. By leveraging technology, insurers can offer customized coverage solutions, accurate risk assessments, and competitive pricing, ultimately empowering small businesses to navigate the evolving risk landscape.

Ultimate Conclusion

Ultimately, securing the right insurance coverage is an investment in your business’s future. By understanding the factors that influence costs, implementing cost-saving strategies, and working closely with insurance professionals, you can navigate the complex world of small business insurance with confidence. This comprehensive guide provides a roadmap to navigating the complexities of insurance, empowering you to make informed decisions that protect your business and pave the way for sustainable growth.